Malaysians are becoming an increasingly connected society, with the growth of devices connected to the internet paving the way for the flourishing of online retail. The Southeast Asian Digital Market is projected to grow to a whopping US$200 Billion by 2025, and this growth is predicted to be largely driven by the growth of first-hand e-Commerce (Google & Temasek, 2016)

The e-Commerce market in SEA itself is expected to reach over US$88 Billion in 10 years, with a 32% CAGR, as opposed to traditional retail at a relatively paltry 7% CAGR (Google & Temasek, 2016). If we are to ride on this wave of opportunity, it is imperative that we identify just how much consumers are satisfied with current e-Commerce offerings, and to strive to improve upon the most pertinent issues.

Executive Summary

SITEC conducted a preliminary, qualitative survey (sample size: 102) between June and August 2016 in order to gain a better understanding of the more pressing issues on the minds of consumers of online shopping in Malaysia.

This preliminary survey aims to identify and narrow down the key issues prevalent in the e-Commerce ecosystem in Malaysia by gathering general sentiments of e-Commerce consumers about the various parts of said ecosystem.

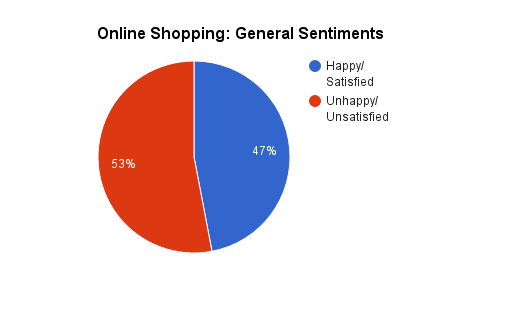

Consumer Sentiment Split Almost Evenly

According to another recent survey by Nanyang Siang Pau, as reported by eCommerceMILO, only 12% of consumers are really satisfied with online shopping, and another 38% are “in-between” in terms of satisfaction level.

The other half of consumers believe that there is still room for improvement in e-shopping sites (Wong, 2016).

This is rather similar to the findings of our survey, where we found that more than half of respondents see room for improvement in e-Commerce.

In our survey, 47% of our respondents clearly indicated that they are satisfied or have no issues with online shopping, with the other 53% clearly indicating that there is still room for improvement.

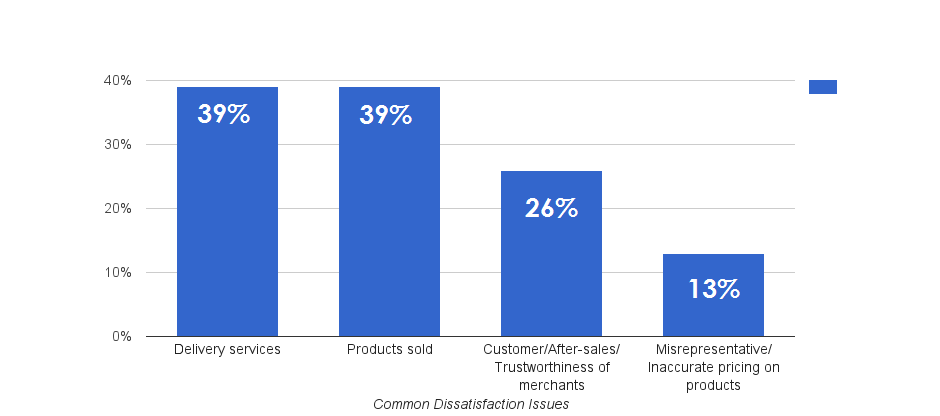

Of the latter, 39% indicate dissatisfaction with current delivery services, whilst another 39% are unsatisfied with the products sold online, citing issues with unclear, misleading or insufficient product descriptions.

26% indicated dissatisfaction with customer service, lack of trustworthiness of sellers, or a lack of proper after-sales service. 13% indicated issues with misrepresentative or inaccurate pricing on products.

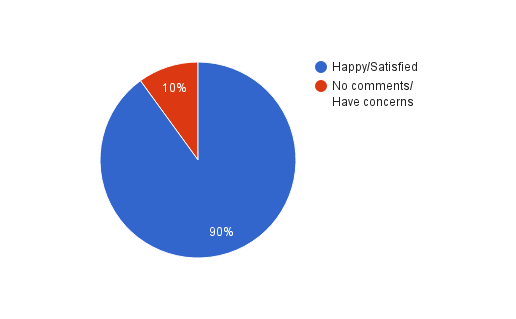

Payment Gateways

Online shoppers are generally very happy with the current online payment gateways available, with 90% of shoppers indicating no issues.

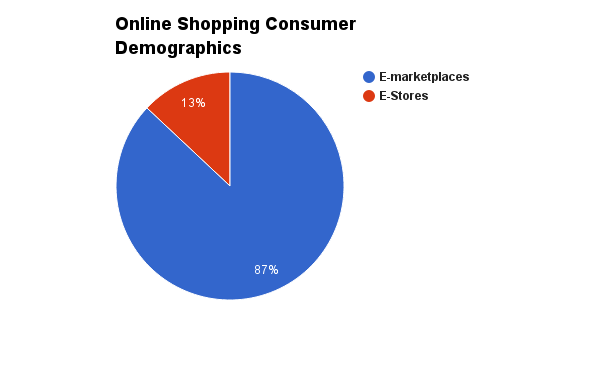

E-Marketplaces

87% are familiar with and patronise online marketplaces more than indie/standalone e-stores.

Lazada is a clear crowd favourite with over 55% having shopped on it, whereas 45% are familiar with 11street.my.

20% of respondents are familiar with Lelong.my, whereas 15% are familiar with Youbeli.com.

However, 53% indicate dissatisfaction in their experience shopping on e-marketplaces.

Much Room for Improvement with Current Delivery/Logistics Services

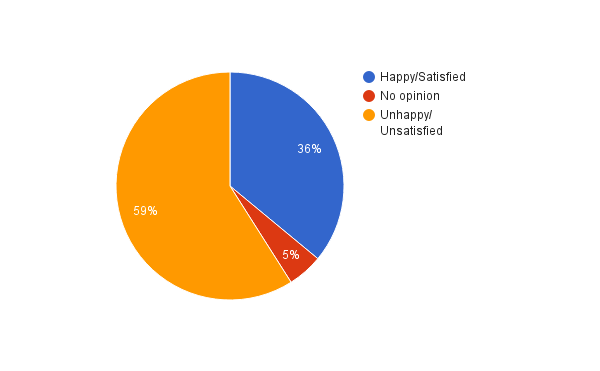

Within this segment of the survey, only 36% of respondents are happy or have no issues with the current delivery standards here, while another 5% were not specify any opinion.

59% of e-shoppers are still largely unhappy with current delivery services.

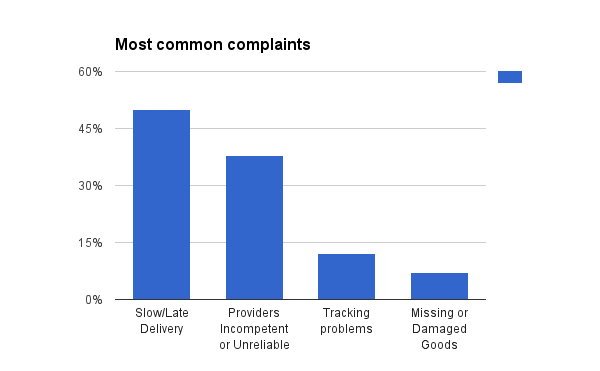

50% have complained of slow or late deliveries, 38% feel that delivery providers are incompetent or unreliable, 12% indicate issues with tracking and 7% complain about missing or damaged goods.

Other Comments

44% of total respondents had additional grouses with e-Commerce in Malaysia. Three major trends emerged, namely, issues with i) Seller Proficiency, ii) Delivery/Logistics, iii) Price

55% of this population of respondents feel that there can be further improvement in seller proficiency, product descriptions, user interfaces, and selling/marketing practices.

25% reiterated that delivery services require more improvement in terms of speed, efficiency and reliability, while 10% had issues with pricing of delivery services or product prices.

Conclusion

The results show that logistics and delivery are the biggest issues on the minds of consumers, with the biggest feedback centred on the speed, efficiency and reliability of delivery services, suggesting that there is much room for improvement in this area.

Other themes emerged as well, such as overwhelming satisfaction with payment gateways, the popularity of e-marketplaces (vs indie e-stores), and how consumers still find that e-marketplaces can still improve in the areas of product descriptions, seller proficiency, and pricing.

References

Google, & Temasek. (2016, May 27). E-conomy SEA: Unlocking the $200 Billion digital Opportunity in Southeast Asia. Retrieved August 6, 2016, from http://apac.thinkwithgoogle.com/research-studies/e-conomy-sea-unlocking-200b-digital-opportunity.html

Wong, C. (2016, July 13). 2016 Malaysian online shopping behaviour. Retrieved August 06, 2016, from http://www.ecommercemilo.com/2016/07/2016-malaysian-online-shopping-behaviour.html

Download our paper now: SITEC Consumer Sentiment Survey 2016